Financial Tips

To read the original, illustrated article, click here: Financial Tips

It’s no secret that money is one of the biggest stressors in the United States today. It mostly takes two incomes to sustain families today. Unfortunately, these two incomes are not always guaranteed; one spouse may not make money all the time; there are single family homes; and well-paying jobs are scarce in the last five years. A well thought out financial plan can put you in good financial standing, allowing you to live a life that is financially stable.

Identifying the problems

As much as all of us know exactly how much we make, not all have a good grip on how much they spend. Many articles will outline the problems. These include personality spending habits, definition of children needs, no savings, debt issues, as well as over-budgeting. While these are real, what are the steps to combat these problems?

The beginning….

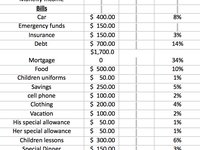

Create a budget. No viable company worth its salt will operate without a Budget Plan or cash flow statement. There is no simple way to say this. You need a simple way to track your expenses:

What this does, it helps you identify what expenses affect your income the most and what expenses are adjustable or expendable.

Next steps

Most people regard expenses as a basic need but fail to thoroughly analyze alternatives or cheaper ways to make this work.

Vet your expenses. Notice the largest example of expenditure is the mortgage or rent. Find the best alternative to your rent or mortgage to reduce the percentage of expenditure; this could free up money for private education for a child or squeeze in some funds to buy the teenage son or daughter a car. If single, evaluate your needs and how much space is needed. Do not live above your means.

Food is an area which most overlook. The average lunch spent at work is $7, which translates to $140 a month for one person! This does not include dinner and snacks either. Take-from-home lunches are the best solution here. New Life Church sponsors some cooking classes show-casing delicious healthy meals at a fraction of the cost of buying take-out, unhealthy dinners.

You can reduce costs spent on the car, if it is reliable. Examples include buying a 2013 model instead of a 2015, reducing the total cost significantly. Cars depreciate between 11-20% as they leave the dealer parking lot. Remember, a used car doesn’t have to be very old because this leads to unnecessary repairs. The rule of thumb while buying a used vehicle is to research the history using tools such as Carfax. Buy cars with less than 80,000 miles, and buy cars with efficient gas mileage. Avoid SUVs. Long lasting vehicles such as Hondas and Toyotas are good choices. Foreign cars such as BMWs and Volvos have large repair costs because of expensive auto parts. Avoid Salvage titles which can lead to low re-sale value as well as unexpected repairs.

Debt is a hot-button area that can pile on and overwhelm. While student debt is difficult to overcome right away, it is best to pay off credit card debt by taking the net saving amount [from your budget] and applying this to credit cards until paid down. Attack one credit card at a time, and when paid, use the amount to pay down the next manageable debt. Do not spend on credit cards as you pay down debt. Also, stick to your budget.

Do not spend money with no provisions in your budget. Personal preferences can be taken care of by allotting monthly amounts on a monthly budget. A special allowance budgeted as an expense does not mean it has to be spent in the same month. This approach will reduce tensions in a family because expectations are pre-set. Good, cordial, respectful, communication is the special ingredient to make this work.

Save for vacations on a monthly basis as well as setting aside funds for a special occasion. This provision as well as the special allowance provision will balance the tendency to penny-pinch.

You need an emergency fund just in case your car breaks down or a child needs some braces. Also remember always to keep about $200 in cash around the house in case there is an earth-quake or other natural disaster, which would mean ATMs would be non-operational.